ESG Vs Double Materiality – Understanding The Difference

Quarter 1 – 2024

What Is Materiality? And How Does It Impact Your Organisation?

Materiality has become somewhat of a ‘buzz word’ in the sustainability space particularly with the deadline closing for many to report against the Corporate Sustainability Reporting Directive (CSRD) which requires Double Materiality. But what is materiality? And how does it impact your organisation?

Materiality is derived from a core accounting concept which focuses on addressing the needs of investors from a financial and economic perspective. However, more recently materiality has been developed with a broader view, considering the needs of all stakeholders as opposed to just shareholders.

With this wider lens of a stakeholder focused approach increasing in popularity, companies also began to look outside of just financial and economic topics to include environmental and social matters. This concept has developed for over a decade, being known as ESG Materiality covering environmental, social, and governance, as well as economic matters. ESG Materiality is used to understand impact on business value, as well as their importance to stakeholders. It became an “official concept” in 2006 when the Global Reporting Initiative (GRI) introduced specific guidelines for materiality assessments as part of sustainability reporting.

A new type of materiality assessment is being brought to the attention of businesses, known as Double Materiality, which takes ESG Materiality one step further. The European Sustainability Reporting Standards (ESRS), under the CSRD, define it as an assessment of both how a business is financially impacted by ESG issues (Financial Materiality) as well as how the business’ activities impact both the environment and society (Impact Materiality). This is now commonly being referred to as an ‘outside-in’ and ‘inside-out’ approach. With the CSRD around the corner, Double Materiality is something businesses will need to take note of as it is a mandatory requirement of the new legislation.

CSRD has been introduced following a period of increased pressure for organisations to have more transparency around their non-financial reporting. It comes in as a replacement for the Non-Financial Reporting Directive which is seen as a less stringent regulation giving organisations flexibility on the level of information they report. Through the CSRD the demand for more detailed disclosures on environmental and social topics has increased, pushing the need for more rigorous reporting guidelines.

Although some see it as overwhelming, the CSRD is an indication of the direction of travel and so organisations need to get prepared. This legislation only applies to organisations based in or with operations in the EU, but that does not mean that others should not take note, as previous patterns suggest it will not be long until neighbouring jurisdictions such as the United Kingdom, Asia and the United States follow suit.

This concept of Double Materiality is widely seen as a positive by non-financial reporting experts as it brings both environmental and social impacts to the forefront of importance. Although we have seen a number of industry standards calling for attention on these issues – environmental impacts more so as we see disclosure against the Taskforce for Climate-related Financial Disclosure become mandatory across the globe – it is a positive movement that the new legislation calls for a focus on both the environmental and social impact.

Conducting a materiality assessment is an important step in enabling businesses to develop comprehensive, and evidence- based strategies. By identifying priority areas, it enables the efficient and meaningful use of time and resource and plays a vital role in developing the organisations culture and underlying business model.

But, with Double Materiality looming it can be difficult to know which approach to materiality is best for your organisation.

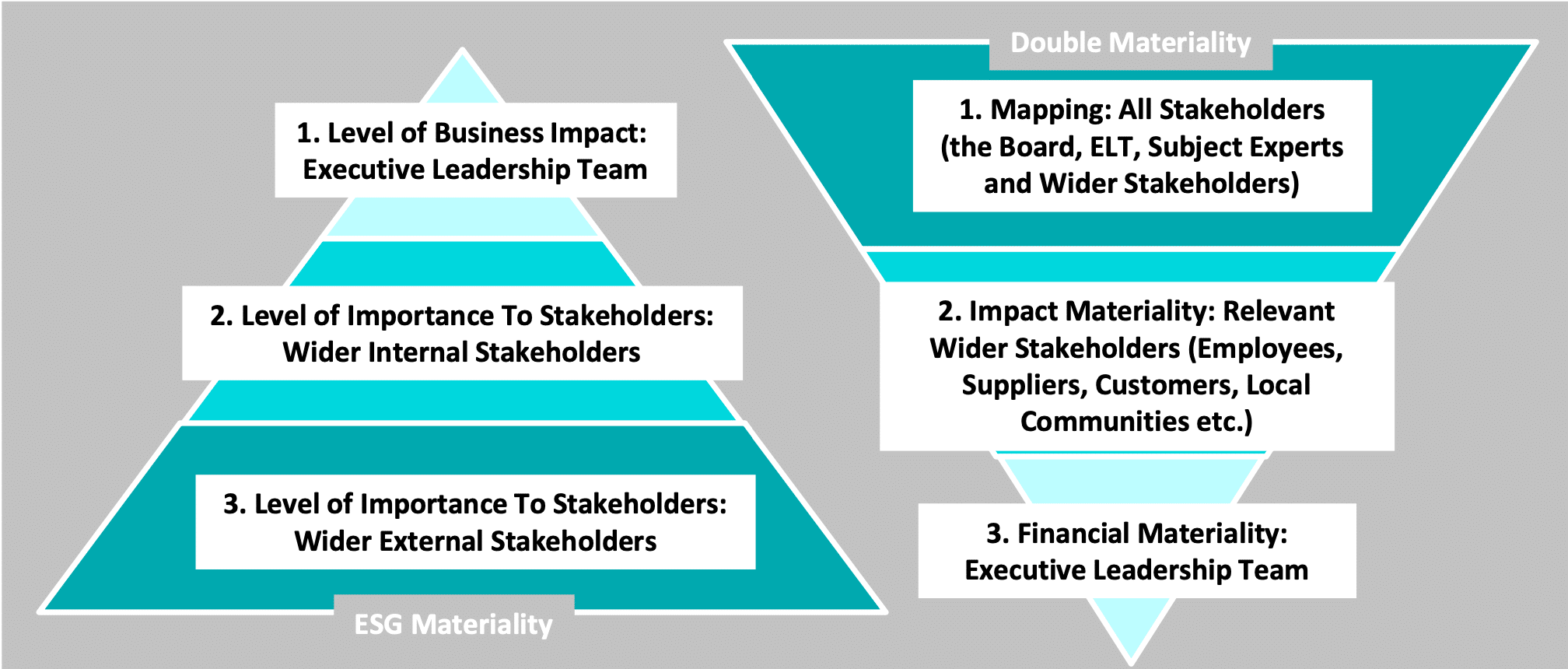

Although the Double Materiality concept may seems like a simple extension of ESG materiality, it is more complex than this when it comes to undertaking the assessment. The diagram overleaf demonstrates the different approach, which at the core underpins how these assessments are distinct.

The diagram above demonstrate the different approach to undertaking an ESG vs Double Materiality Assessment. ESG Materiality focuses largely on the business impact and the opinions of stakeholders. Meaning that during the assessment phase much of the analysis involves internal stakeholders, with external stakeholders being consulted in the final stages to ascertain their view in regard to how important they believe the topics are.

In contrast, although Double Materiality also has a focus on business impact it is more largely focused on the impact to stakeholders in comparison (not just their view), inclusive of the wider environment and society. Therefore, when conducting an assessment, ESRS guidance suggests that consulting a broad range of stakeholders is the best approach to start with, before narrowing the issues down as the process develops and the materiality of topics become clear. Fundamentally this demonstrates a shift of focus from pure stakeholder engagement. to a more robust approach to assessing environmental and social impact.

Also, in the case of assessing business impact for Double Materiality the focus is more specific, although it is still in debate as to the exact definition of the ‘financial impact materiality’ it is largely agreed that it will be based on a risk and opportunity perspective. At this stage there are limited guidelines from CSRD around this, but we do know that business impact will have a narrower focus asking businesses to concentrate on how environmental and social issues could translate to financial risks and opportunities.

Asesoria’s Comment

Asesoria has been conducting materiality assessments for over 10 years helping businesses to understand how ESG topics have an impact on their business and stakeholders; developing our approach alongside new guidance and regulations. With the new CSRD legislation we have further developed our approach to include Double Materiality which will be mandatory for many from 2024 reporting.

Our clients suggest that this new legislation has them questioning how they should approach reporting on materiality. Is ESG Materiality appropriate for them as this stage or is it time to undertake a Double Materiality Assessment?

Some have argued that regardless of whether your business is in scope of the CSRD requirements, now is the time to start preparing for Double Materiality. We are not so sure that this is a topic which can be given a ‘one size fits all’ recommendation.

What some have failed to remember is that yes, CSRD will become mandatory for thousands of businesses, and yes, it is likely to become a global standard in subsequent years, but some organisations, even some of the largest, have not yet introduced a basic ESG materiality assessment into their reporting or to inform their strategy. Regulators recognise that ESG compliance is a journey and due to varying organisational sizes and budgets, disclosure often reflects this.

Conducting a materiality assessment is a key first step to achieving transparent, detailed and relevant reporting. However, if businesses are yet to conduct any type of formal ESG materiality assessment this is where they should start, in order to give themselves a solid starting point to later build on. In 2021 the Global Reporting Initiative (GRI) published the Universal Standards which focus on impact reporting for a multi-stakeholder audience, a standard materiality assessment is sufficient to address this.

For organisations who have already started reporting on material issues it is now an appropriate time to take the next step and start conducting a double materiality assessment. Although an ESG materiality assessment is still an appropriate next step for a large number of organisations, it should still be remembered that more recently GRI have published a report stating that Double Materiality should be a ‘guiding principle’ and is an ‘exercise which GRI supports’. SASB has also published on the topic of Double Materiality explaining that it is a ‘necessary shift in the corporate approach’. Although it is not mandatory as part of GRI or SASB disclosures it is still seen as best practice. As the information suggests, the first few years of reporting will lead to varying levels of compliance and disclosure as companies learn what the regulators are looking for, so it is a great time to get ahead of your competitors.

Regardless of this debate, for those in scope of CSRD, Double Materiality is not going to be a choice with reporting mandatory from FY 2024, so companies affected by it will have to begin putting processes in place this year, to enable them to collect the required information and data to make these disclosures.