Clarity at last for CSRD

As we move into 2026, the EU has finally completed the legal processes to bring the Omnibus Revisions onto the Official Journal of the European Union in late January. At last, we have much needed clarity on the EU’s Corporate Sustainability Reporting Directive (CSRD) and Corporate Sustainability Due Diligence Directive (CSDDD).

While the Omnibus process created a period of uncertainty, the revisions being made are simplifications and will lead to a significant reduction in the number of organisations impacted. These simplifications intend to reduce reporting burden and promote market competitiveness. This paper discusses these simplifications, what entities need to do and detail on the new timelines and scopes.

The companies impacted by these two directives

CSRD new threshold: 1,000 employees with a turnover rate of €450 million. However, companies that are considered ‘non-EU’ and have parent companies that reside outside of the EU must have an income within the EU that reaches €450 million or over (for two years in a row). However, companies with subsidiaries and/or branches in the EU must report when income for these subsidiaries and/or branches reaches over €200 million per fiscal year.

Exemptions and those entities out of scope include:

– Financial holdings that do not involve themselves in management of subsidiaries.

– Entities exempt from reporting if their data is included within their parent company’s CSRD report.

– Member states can give a transition exemption for companies that were previously part of ‘Wave One’ of CSRD reporting (financial year of 2024) but no longer fall within the financial threshold of €450 million.

– If companies are unable to produce information, within the first three years, they may explain why they are unable to comply instead. Companies are also not required to share information that is sensitive or classified. Parent companies now have until the next financial year to declare sustainability information about an undertaking that has been acquired, merged, or has left, if there is reason in a submitted management report. However, it is preferable that this information is declared in the same financial year.

In terms of dealings across the Value Chain, in scope organisations also must consider the following:

– ‘Value chain cap.’ This includes introducing a limit on the amount of information large companies can reasonably request from ‘protected undertakings’ (companies with less than 1000 employees) in their value chain.

– Large companies must also understand that undertakings have a statutory right to decline when sharing information and that the undertakings are able to determine themselves if they are considered ‘protected’ or not based on the number of employees. However, it is important to note that ‘reasonable requests’ are permitted, meaning that larger companies can request information that ‘aligns’ with the voluntary sustainable reporting standards.

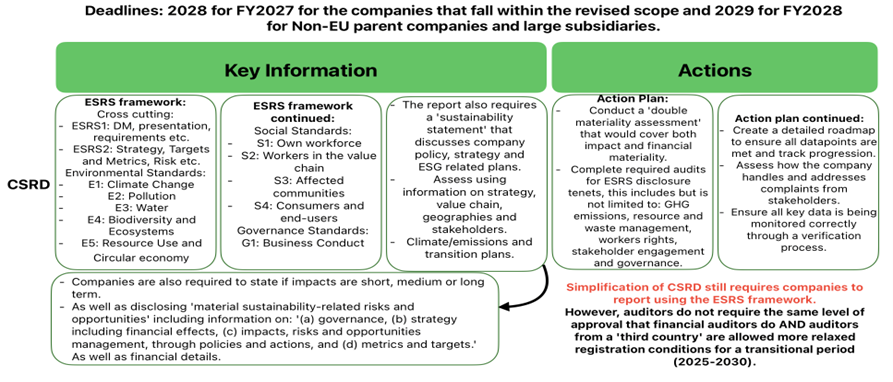

Moreover, the limited assurance model adoption will be postponed to 2027 (meaning a more relaxed vetting process for CSRD required information), and sector specific mandatory guidelines have been abolished. However, the ESRS may provide suggested guidance on sector specific reporting. An online portal will also be made available with new information and guidance on ‘reporting standards.’

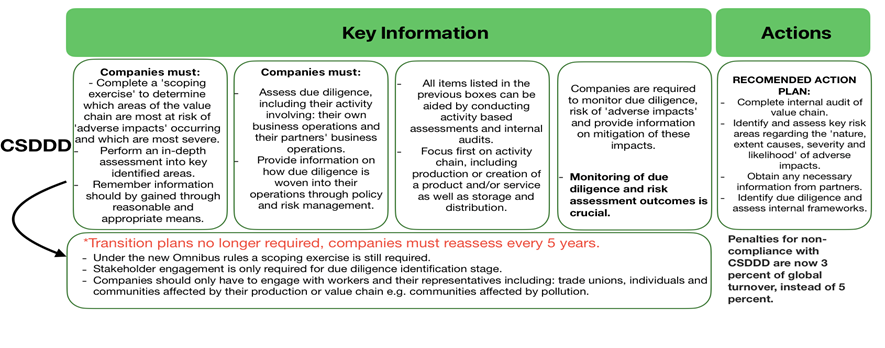

CSDDD: new threshold: 5,000 employees and a turnover rate of €1.5 billion per financial year. This also applies for non-EU companies or groups that generate a profit over €1.5 billion per financial year within the EU. However, for companies that have franchises or ‘licensing agreements’ within the EU the threshold is now €75 million in royalties and the turnover threshold is now €275 million within the EU.

Information may only be reasonably obtained by other companies within the value chain that have less than 5000 employees if the information cannot be gathered using other means. Additionally, if a business that a company is working with is inflicting great damage, (environmental, breaking labour laws etc.,) instead of terminating contracts as was previously advised, companies must now suspend contracts until the issue is resolved. Harmonised liability laws have also been removed to ensure EU law does not override national law.

What does this mean for organisations and what actions need to be taken and when?

While final wording is still being concluded the likelihood is that the following are key:

Asesoria’s Perspective:

The reduced scope and simplified reporting will be a welcome relief to many organisations and there are undoubted benefits.

• The new timelines, allows for more time and resources to go into meeting new requirements and fulfilling strategy and transition-based policies. E.g. GHG Emission Scope 1, 2 and 3 reductions.

• The lighter regulatory burden may also ensure Europe is attractive for investment, as regulatory simplification will reduce burden and allow for companies to prosper without added strain.

In conclusion, this long-awaited clarification is very welcome and provides certainty that business needs. It allows detailed plans and action to proceed and while not appreciated in all corners, it is a pragmatic approach which will be welcome by many. However, putting the legislative aspect to one side, the facts and evidence are that climate change risks are growing and having a broad impact and therefore whether impacted by CSRD or not companies need to plan adaption measures and consider the risks and potential opportunities within their business models.